Illinois Law requires taxing districts to estimate the amount of money needed from property taxes at least 20 days prior to adoption of their final annual levy. If that amount is more than 5% of the prior tax year’s extensions, the taxing district must give public notice and hold a public hearing on the levy.

The Law now requires that the website notice be posted for a period of not less than 30 consecutive days. Prior to this amendment, no separate time frame was specified for the website posting of the public notice. The Law still requires that such notice be published in a newspaper “not more than 14 days nor less than 7 days prior to the date of the public hearing,” and contains detailed requirements for the form and content of that notice. Thus, a taxing district must now be mindful of the 20-day period for estimating their levy, the 7-to-14 day newspaper notice period, and the new 30-day website notice period.

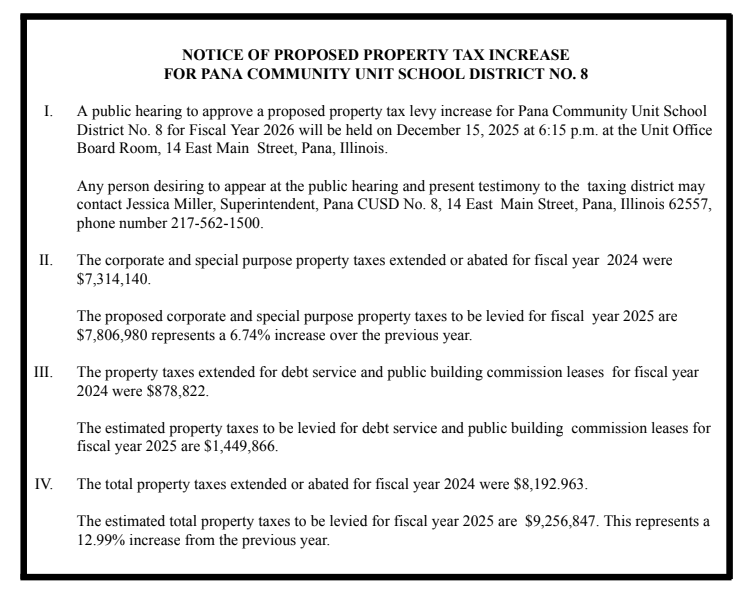

As such, the Tentative Levy for consideration by the Board of Education at their November 17th, 2025 regular meeting is as follows. If adopted, a public hearing to approve a proposed property tax levy increase is tentatively scheduled for Monday, December 15, 2025 at 6:15 pm in the Unit Office Conference Room.